Written by Michelle Sofia Michelle Sofia

Financial Content Architect & SEO Market Analyst

As a financial journalist and a SEO specialist my passion for making education in finance accessible runs deep. My work combines hands-on market trend analysis with straightforward writing to create content that’s both informative and easy to understand for the average reader. At CleaRank, we’ve built our reputation on a simple idea: transparent broker comparisons shouldn’t be reserved for experts because everyone deserves clear and transparent information, especially when it comes to choosing a broker. Day to day, I focus on refining our educational materials to maximize their visibility and usefulness across trading communities. using our CLEAR™ Methodology The CLEAR™ Score (Credibility, Leverage, Execution, Accessibility, Regulation) is our proprietary ranking system. The CLEAR™ Score provides you with the most accurate and transparent broker ranking after evaluating all the key factors that are crucial for trading success. .

Last fact check on September 9, 2025 by

Jacob Bakshi Jacob Bakshi

CFD & Options Trading Specialist

Trading CFDs and options has been my playground for years, and I love helping others understand these powerful tools and what makes the financial world tick. My work mostly focuses on giving traders the confidence to make informed decisions with unbiased reviews into platforms that prioritize fair pricing, advanced tools, and reliable execution because In fast-moving markets, every detail matters. I have a background in market analysis and risk management, and I’m always on the lookout for brokers that offer the right tools for serious traders.

Rheinmetall Stock Forecast 2025: Will Europe’s Top Defense Stock Keep Soaring?

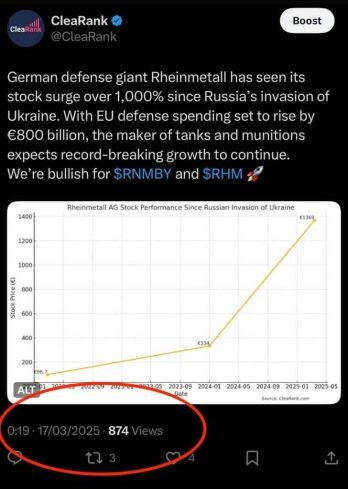

Rheinmetall AG (ETR: RHM/OTCMKTS: RNMBY) has extended its meteoric run in 2025, rising nearly 15% since CleaRank issued a “strong buy” signal on March 17, 2025. The German defense contractor is now one of the best-performing stocks in Europe, fueled by record defense spending, strong financials, and growing investor confidence in the long-term military rearmament cycle across NATO states and their push to boost defense spending to 2.5% of GDP by 2030.

CleaRank Called It First

On March 17, CleaRank’s analysts posted a strong buy recommendation on Rheinmetall via their official X account @CleaRank, citing a combination of geopolitical tailwinds and upcoming institutional rebalancing in defense-heavy portfolios.

At the time of the call, Rheinmetall was trading at approximately €1,370 per share. As of July 18, the stock trades around €1,842, a 34% gain in under four months, significantly outperforming European indices over the same period.

Rheinmetall AG Stock Performance

Pricing Movement Since CleaRank Buy Signal

Fundamentals Behind the Surge

Rheinmetall is benefiting from a perfect storm of macro and sector-specific factors. Most notably:

In 2024, Rheinmetall reported a 36% jump in annual revenue, reaching nearly €9.75 billion, according to its latest filings. Analysts expect that number to climb significantly in 2025 as orders accelerate.

Strategic Positioning and Market Outlook

There are plenty of fundamentals backing a Rheinmetall surge especially if we consider its developing position as a strategic partner for defense alliances beyond Europe. The company is constantly expanding its production capacity within the EU while actively deepening its industrial cooperation with the U.S.

According to a statement from the company’s CEO, Rheinmetall’s order backlog could exceed €300 billion by 2030, underscoring the firm’s relevance in Europe’s long-term defense posture.

This broader macro thesis — that Rheinmetall is not just a war-driven play, but a core beneficiary of structural military investment — is what keeps investors bullish even at elevated valuations.

Wall Street’s Split Verdict: “Overheated” vs. “Underpriced”

Wall Street Analysts remain divided, with 13 of them tracked by TipRanks rate RHM a “Strong Buy” on average, their €1,417 price target implies a 10% downside from current levels. Critics point to a sky-high P/E ratio of 85.1x — triple the industry average — and debt-to-equity of 47%.

Key Metrics Behind this Debate:

HSBC and Barclays remain skeptical, slapping “Buy” ratings with bearish €1,000 and €590 targets, respectively, citing stretched valuations.

Risks Remain, But Momentum Dominates

Even with a 130% YTD gain, caution is still warranted. Valuation multiples are on the rise, and any delays in contract execution or geopolitical resolution could lead to profit-taking and a quick sell-off. However, the risk-reward ratio still appears attractive.

CleaRank Senior Derivatives Strategist Jacob Bakshi has doubled down on Rheinmetall with a medium-term forecast of +160% surge from current levels, stating:

“As long as European defense budgets stay elevated, Rheinmetall has a multi-quarter runway for growth. With scaled production, limited competitors, and regulatory backing, this stock could triple by Q4.”

That forecast implies a price target of approximately €4,100 by November 2025 — an aggressive but not unthinkable scenario if military rearmament intensifies. It’s a target that dwarfs Wall Street’s highest estimate of €2,000 and Bakshi’s bullish thesis hinges on three pillars:

- Record Defense Contracts: Rheinmetall’s €30 billion order backlog, fueled by NATO rearmament and Ukraine-related demand for artillery and armored vehicles.

- EV Pivot Acceleration: Its Sensors division is securing deals with Tesla and BYD for electric vehicle components, diversifying revenue beyond defense.

- Geopolitical “Forever War” Premium: Escalating tensions in Taiwan and the Middle East position Rheinmetall as a top supplier of next-gen military tech, including drone systems and cyber warfare solutions.

“This isn’t just a cyclical play — it’s a structural shift,” Bakshi told CleaRank Insights. “Rheinmetall’s valuation multiples will expand as defense becomes the new growth sector.”

Q1 Earnings: Blowout Quarter Confirms the Bull Case

Forget a make-or-break moment — Rheinmetall’s Q1 2025 earnings crushed expectations and poured rocket fuel on an already explosive rally. Revenue soared 46% year-over-year to €2.31 billion, handily beating forecasts, while operating profit jumped 49% to €199 million. EPS came in at €1.92, well above the €1.13 posted a year earlier. But the headline grabber? A staggering €11 billion in new orders — nearly triple the intake from Q1 2024 — pushing Rheinmetall’s total order backlog to a record €62.6 billion.

Even more bullish: €266 million in free cash flow, a massive reversal from negative territory last year, and strong performance across every defense segment, especially in armored vehicle systems and NATO-grade ammunition. Civilian engine sales did contract, but the defense juggernaut easily overshadowed that softness. This is the kind of earnings report that doesn't just justify a 15% rally — it supercharges Bakshi’s 160% price target with fresh ammo. He adds, “A 73% surge in Defense sales, €11B in orders, and a €266M cash flow swing — Rheinmetall’s Q1 2025 wasn’t just strong, it was historic.”

Rheinmetall Q1 Earnings Comparison

Q1 2024 vs Q1 2025

Civilian Exit: Why Rheinmetall’s Power Systems Sale Adds Fuel to the Rally

Rheinmetall's latest strategic move? Getting leaner and meaner. On July 16, the company confirmed it is deep in talks with multiple bidders — including private equity giant One Equity Partners — to offload its struggling Power Systems division, the last remaining civilian-focused arm in its portfolio. While some saw this as a quiet restructuring, smart money sees something bigger: a pure-play transformation into Europe’s most focused military powerhouse.

Power Systems has long been the weakest link in Rheinmetall’s otherwise bulletproof balance sheet. In Q1 2025, the division reported a 70.4% collapse in operating profit, generating just €9 million despite €505 million in sales — a 7% drop year-over-year. Not exactly the type of growth story that fuels a defense stock’s ascent.

So what’s the market takeaway? Simple:

This pivot aligns perfectly with CEO Armin Papperger’s vision to streamline operations and double down on defense and the timing couldn’t be sharper. With defense budgets across Europe surging and Rheinmetall sitting on €62.6 billion in orders, removing operational distractions aimed directly at value creation.

CleaRank analyst Shaun David shed more light on this:

“By exiting Power Systems, Rheinmetall is sharpening its spear. This is what conviction looks like in a post-neutral Europe.”

It’s the kind of strategic pruning Wall Street rewards and exactly the kind of move that supports the bullish €4,100 price target by year’s end.

Rheinmetall Price Target: What’s Required

With institutional momentum, favorable earnings trends, and no signs of slowing demand, Rheinmetall remains one of the most structurally supported long positions in the European defense sector. The CleaRank buy signal on March 17 has so far proven timely and accurate.

Whether the 160% gain forecast plays out will depend on execution and external stability, but for now, Rheinmetall continues to deliver — both on the battlefield and in the stock market. Rheinmetall embodies the defense sector’s bipolar reality: a cash cow in turbulent times, yet vulnerable to peace talks or budget cuts. For Bakshi’s 160% rally to materialize, the company must:

As CleaRank’s Shaun David notes, “Investors should brace for turbulence — but in a world where wars outnumber rate cuts, Rheinmetall just like Gold remains a hedge against chaos.”

Shaun David, Head of Broker Integrity and Market Analysis

Disclosure:

This analysis is provided for informational purposes only. All prices, data, and forecasts reflect market conditions at the time of writing and the latest fact-check (as of the date specified above). Investors should consult with a qualified financial advisor before making investment decisions.

Frequently Asked Questions

CleaRank started with the simple yet powerful vision that transparent and unbiased broker information should be available to everyone, not just those within the industry. This is where I come in with my many years of experience in financial journalism and SEO. Every day, I focus on creating and refining educational content that truly speaks to trading communities and making it both easy to find and genuinely helpful. It’s all about giving people the knowledge they desperately need in order to make informed decisions—step by step, one article at time.